Calculator Time Weighted Return

This requires month-end portfolio values but avoids having to value the portfolio whenever an external cash flow occurs which is required when. Time-Weighted Rate of Return TWRR 979.

How To Calculate Your Time Weighted Rate Of Return Twrr Canadian Portfolio Manager Blog

Make sure All Files is selected.

Calculator time weighted return. A money-weighted rate of return on the other hand will. In the example above the calculator outputs a money-weighted rate of return of 990. Your time-weighted return would be 110100 130135-1 593 Most often time-weighted returns are approximated by chain linking money-weighted returns IRR.

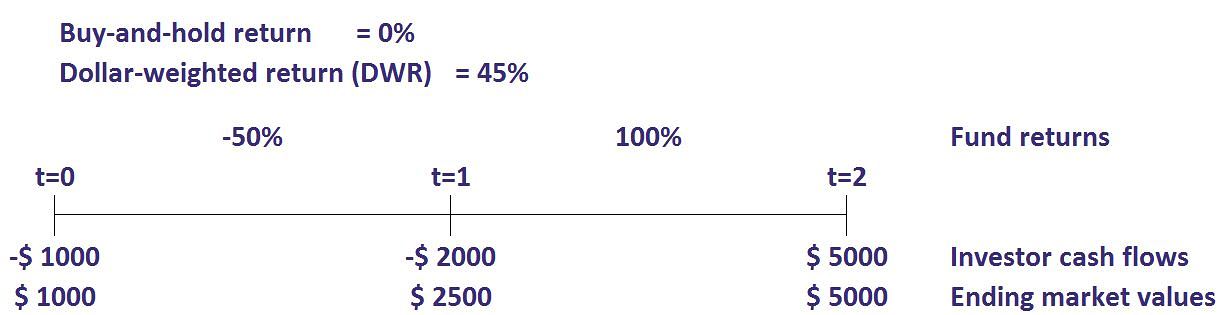

How to Calculate Time Weighted Return Example of subperiod returns throughout January. TWRR is typically used by portfolio manages to compare their portfolios return to either other managed accounts or to an index. The worksheet first calculates the Holding Period Return of the Cash inflow and outflow of each period.

Each investments valuation is needed. You can now upload the xslx file to the calculator. To track the MSCI Canada IMI Index.

1 100. Money-Weighted Rate of Return MWRR 898. Select the ror file on your computer.

Time-Weighted Return Calculator This page calculates the Time-Weighted Return for an investment given the investment valuation and any deposits and withdrawals on a series of dates. The subperiod returns are then linked to calculate the total weighted return. By comparing their MWRR to an index return.

Their investment strategy was exactly the same in each case ie. Next create a new sub-period for each period in which cash moved in or out of the portfolio. Click File Open.

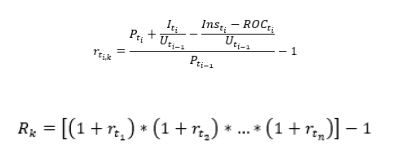

Factors for Time Weighted Return Calculation and The Time Weighted Return Formula. First youll want to calculate the rate of return for each of your sub-periods. TWRR is more difficult to calculate for individuals because it requires more data.

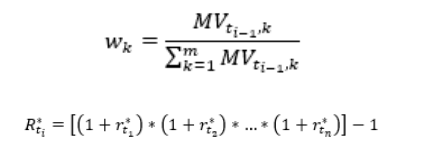

Note that if the period is less than one year it will display the actual rate of return Understanding Your Money-Weighted Rate of Return. The time-weighted rate of return calculates the return of 1 invested since the beginning of the period. Each investors cash flow decision resulted in a higher or lower MWRR relative to the TWRR.

We believe that the TWR methodology best represents the true performance of your portfolio because it solely reflects the effects of the. It does not penalize you for bad timing such as taking out 150 right before the market recovery. The time-weighted rate of return is a method for calculating the compound growth rate in a portfolio.

You can do this by subtracting the beginning balance of the period from the ending balance of the period. Most asset managers will publish their results in both time-weighted TWRR and dollar-weighted DWRR rates of return. Time-weighted return TWR is the industry standard for managed portfolios and market indexes.

It is used to compare the returns of investment managers by removing the effect of cash withdrawals and additions to the portfolio. Then divide the difference by the beginning balance of the period. And you may not be calculating time-weighted returnthe method best used to compare investment managers who dont control the timing of deposits and withdrawals.

To calculate TWRR the account history is divided into sub-periods representing the interval between significant cash flow events or valuation dates. Click File Save As. TWR 1 RN 1 RN.

Save a new File on your computer. This can be accomplished by calculating the Modified Dietz rate of return over monthly time periods and then geometrically linking the results going forward I will refer to this methodology as the approximate time-weighted rate of return. Time Weighted Return 1Holding Period Return at time 1 1Holding Period Return at time 2.

The TWRR time weighted rate of return is computed by geometrically linking the rate of return for each sub-period. How to Calculate the Time-Weighted Return. Less data is needed but also a bit of time-weighting accuracy is lost.

Choose Excel Workbook xslx format.

Weighted Average Cost Of Capital Wacc In 2021 Cost Of Capital Finance Investing Accounting Education

Bad Debt Reserve Calculator Template Efinancialmodels Bad Debt Debt Reduction Plan Debt

Implementation Create A Lean Agile Center Of Excellence Scaled Agile Framework Center Of Excellence Change Management Agile

Twr Vs Mwr Calculating The Benefits Of Deposit And Withdrawal

Weighted Average Cost Of Capital Wacc The Firm S Overall Cost Of Capital Considering All Of The Com Cost Of Capital Accounting And Finance Financial Analyst

How To Calculate Your Time Weighted Rate Of Return Twrr Canadian Portfolio Manager Blog

How To Calculate Your Modified Dietz Rate Of Return Moddietz Canadian Portfolio Manager Blog

Irr Formula Google Meklesana Formula Cash Flow

Irr Internal Rate Of Return Definition Example Financial Calculators Cost Of Capital Rate

How To Calculate Your Time Weighted Rate Of Return Twrr Canadian Portfolio Manager Blog

Time Weighted Rate Of Return Twrr Simple Fund 360 Knowledge Centre

Time Weighted Rate Of Return Twrr Simple Fund 360 Knowledge Centre

Dollar Weighted Return Breaking Down Finance

Step 2 Calculate The Cost Of Equity Stock Analysis Cost Of Capital Step Guide

Alex Tran Though A Little Long This Video Is Very Thorough In Its Explanation On How To Calculate Sales Mix Or T Contribution Margin Weighted Average Finance

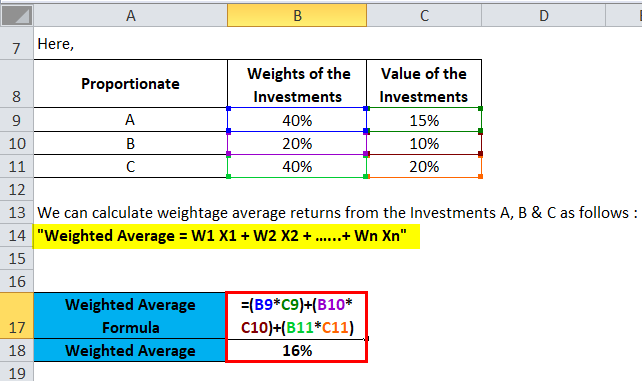

Weighted Average Formula Calculator Excel Template

What Is The Formula For Calculating Net Present Value Npv In Excel Excel Formula Calculator

Weighted Average Cost Of Capital Wacc Excel Formula Cost Of Capital Excel Formula Stock Analysis

Post a Comment for "Calculator Time Weighted Return"