Can I Invest One Time In Nps

1 Liquidity and National Pension System. All individuals can use the NPS calculator who is eligible to invest in the National Pension Scheme.

Net Promoter Score Benchmarks To Help You Understand Customer Loyalty Customer Loyalty Promotion Scores

On withdrawal 40 of the NPS Tier 1 account balance can be withdrawn tax-free.

Can i invest one time in nps. They also have to shell out one-time charges at the time of on-boarding and pay a flat fee on every transaction. Introducing SIP for NPS Now invest in NPS in monthly instalments through the year using automatic payments with EasyPay available on ETMONEY app only. However there is a lock-in of 3 years for government employees who are investing in NPS Tier 2 to avail of a tax deduction.

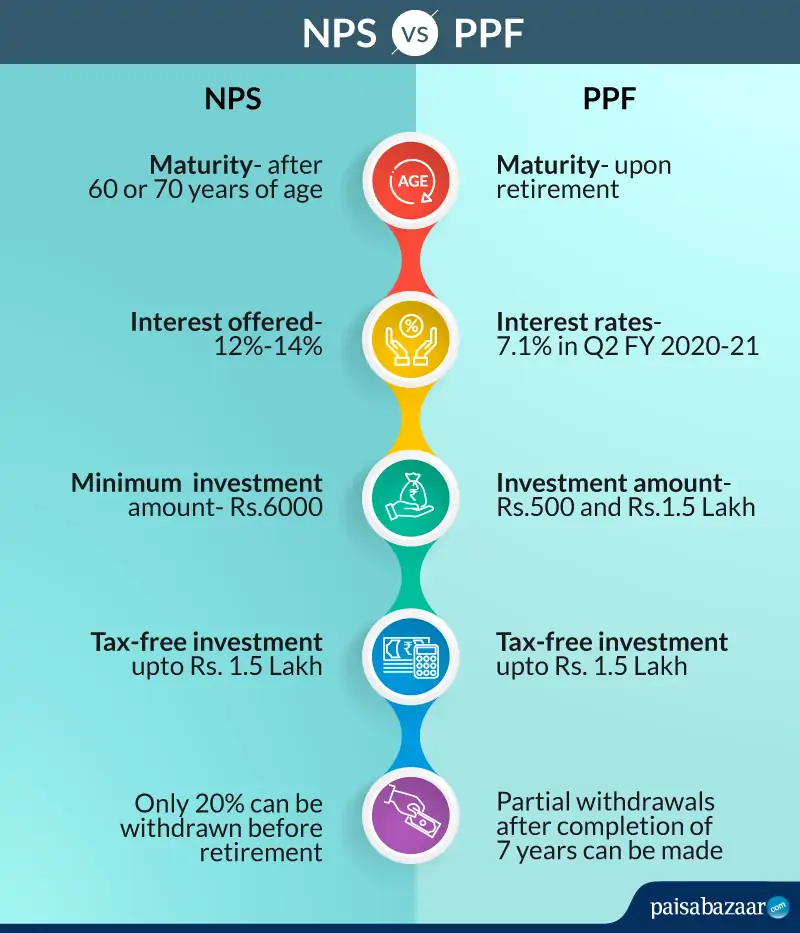

Investments made in NPS mature when an employee retires at the age of 60 years and the subscriber has to invest within three years minimum 40 per cent of the retirement corpus in an. Also the applicant will require to fulfill the Know Your Customer KYC guidelines in order to invest in NPS. Till recently the equity portion of.

What is the minimum contribution in NPS. Either you stick to the old regime where you claim all deductionsexemptions including one offered for NPS but you pay higher tax rate OR you pay lower tax rate but cant claim any deductionsexemptions. No you cannot open multiple NPS accounts.

NPS will not provide a pension. If I cannot redeem at will from the corpus I have invested in then who purpose of. The shift is allowed for investments in NPS Tier I and NPS Tier II account.

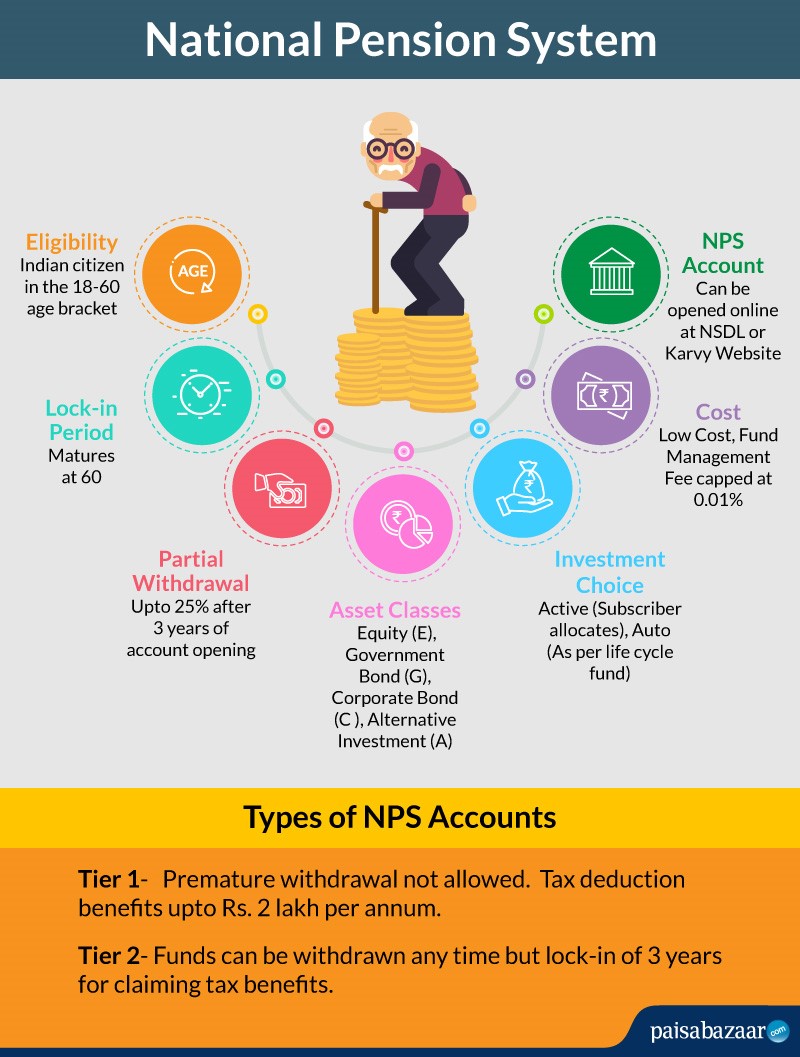

One of the best things about NPS is the flexibility it provides for investments. However there is a minimum Rs 6000 that a subscriber must contribute in a year. NPS Tier 1 is eligible for tax deduction on contributions up to Rs 15 lakh under Section 80 C and an additional Rs 50000 under Section 80 CCD 1B of the Income Tax Act 1961.

You need to buy one yourself. In case you dont mention your preference or choice of fund at the time of registration your investments will be invested in the default funds handled by the Pension Fund Regulatory and Development Authority. Either way you should not be investing in NPS only because it offered tax benefits.

You can withdraw at any time from the NPS Tier 2 account. In fact there is no need to open a second account as NPS is portable across sectors and locations. The flexibility with NPS allows you to change your fund manager once a year and your asset allocation twice in a year.

Unlike the PPF there is no ceiling on the amount one can invest in the NPS. Despite this the NPS is still by far the cheapest market-linked investment product. There is also a 50 per cent ceiling on the allocation to equities.

An NPS subscriber can decide allocation amongst there 4 asset classes. Another 40 must be compulsorily used to buy an annuity monthly pension. Investors willing to invest in the National Pension System NPS cant wait till March 31 to make their contributions to avail the additional tax benefits up to Rs 50000 over and above the 80C.

You can also invest up to Rs 15 Lakhs in NPS under Section 80C. Can I have more than one NPS account. To be sure this is not the only expense for investors.

But NPS investments are not eligible for. Before we talk about NPS two aspects of investing need to be discussed. There is no lock-in for NPS Tier 2.

Liquidity is the most important concept in investing. But investments in the equity funds of the NPS get taxed. This new provision for government employees was announced in a press conference in December 2018 but has not yet been implemented.

Being financially ready for retirement should be. The minimum requirement is just Rs 1000 per year. The fund management charges are 001.

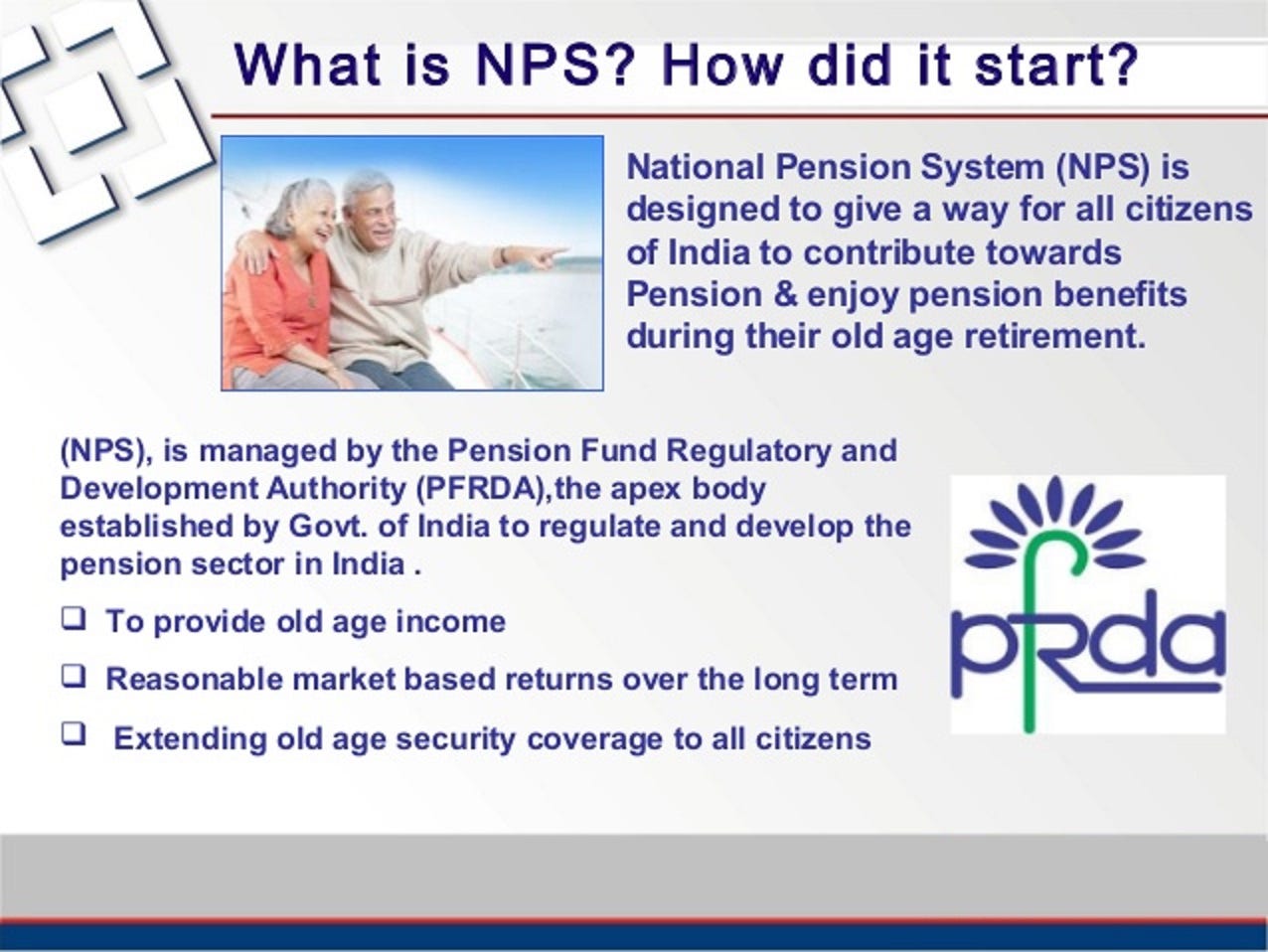

National Pension System NPS is a pension-cum-investment scheme from the government to provide post-retirement security. Investors in debt schemes are taxed at a lower rate after three years and also enjoy indexation benefit. As per the NPS rule all Indian citizens between the age group of 18-60 years are eligible to invest in the pension scheme.

National Pension System NPS allows a subscriber to invest in four asset classes such as Equity Corporate debt Government Bonds and Alternative Investment Funds. So you can start small and as and when you gain confidence and. It is a long-term tax-saving and investment vehicle that invests in.

The Budget gives you two options. If you invest in NPS you can avail a deduction of 15 lakh under. You can make an annual contribution till you turn 60 years of age and the minimum age requirement to invest is 18 years.

That is you can invest when you want and also how much you want. Under the NPS an individual can invest in different pension funds. You have to contribute a minimum of Rs 6000 in your Tier-I account in a financial year.

As an NPS subscriber it is for you to choose the option you wish to exercise and also the fund manager you wish to invest with. Apart from the tax benefits the NPS is also an ultra low-cost investment option. Investors in stocks and equity funds dont have to pay any tax on long-term capital gains.

Though it is a long-term investment NPS investors are not eligible for the tax benefits that other investors enjoy. The NPS offers three different types of funds wherein you can invest and get good returns at retirement.

Should I Invest In Nps Should You Invest In Nps National By Investeek India Medium

Net Promoter Score Nps Survey Template Questions Qualtrics Survey Template Surveys Scores

Nps National Pension Schemes Eligibility Types Calculator

The Times Group Wealth Management Investing Fund Accounting

Uk Benchmarks Net Promoter Score Nps Satmetrix Content Insurance Benchmark Nps

Nps National Pension System Investment Now Overseas Citizens Of India Can Invest In Nps Pensions Nps Certificates Online

Nps National Pension Scheme And Its Mutual Fund Alternative Scripbox

New Pension Scheme Pensions Life Annuity Schemes

Nps Calculator Key Things To Know About Your 6000 Monthly Investment

60 Return In 1 Year Is Nps The Best Option For Retirement Planning Businesstoday

Nps National Pension Scheme A Beginners Guide For Rules Benefits Finance Blog Budget Calculator Personal Finance Blogs

National Pension Scheme And Atal Pension Yojana Main Differences Pensions National Schemes

Nps Vs Sip Which Is A Better Investment Plan Groww

Invest In Nps Investing How To Get Rich How To Plan

6 Reasons Why You Should Invest In Nps In 2021

Is Nps Good For Tax Saving Tax Exemption Saving Nps

Post a Comment for "Can I Invest One Time In Nps"