Ice Risk Free Rate Calculator

Spread Adjustment Floor Incl. The risk-free rate represents the interest an investor would expect from a zero risk investment over a specified period of time.

Https Www Theice Com Publicdocs Iba Us Dollar Ice Bank Yield Index Second Update Pdf

The settings will be determined in line with the methodology proposed by the Non-Linear Task Force of the Working Group on Sterling Risk-Free Reference Rates in its paper Transition in Sterling Non-Linear Derivatives referencing GBP LIBOR ICE Swap.

Ice risk free rate calculator. Secondly IBA has launched the ICE Term Risk Free Rates RFR Portal. Put simply the more risk an investment has the. We are seeking feedback from market participants on the information presented here and how it can be improved further to provide support in the transition from LIBOR towards Risk Free Rates.

LIBOR ICE Swap Rate LBMA Gold and Silver Prices and Treasuries. The data provided on the ICE Term RFR Portal is provided for information purposes only and may not be used as a benchmark in financial instruments. Formula to calculate risk free rate.

ICE is the market leader in alternative reference rates with volume traded in its SONIA futures exceeding 57 trillion notional. Detailed compounding and simple interest calculations for SOFR SONIA ESTR TONAR SORA and SARON. It is usually closer to the base rate of a Central Bank.

The risk free rate should be inflation adjusted. SONIA futures trade alongside our existing interest rate futures and options along with inter-contract spreads. In practice the risk-free rate of return does not truly exist as every investment carries at least a small amount of risk ie.

Consequently each investment that presents a minimum risk can be broken down into a sum of two rates. Please see full legal disclaimer here. Forward-looking one three and six month term risk free rates initially for SONIA derived from futures contracts and published SONIA data1.

Alternatively depending on the version of excel. Risk-Free Rate Formula How to Calculate Rf in CAPM. Treasury bills are used for us.

R f is the rate of a. This is because IBORs representing an average of the rates at which Panel Banks believe that they could borrow money in the interbank market reflect the credit and liquidity risk involved in lending in that interbank market. Please see full legal disclaimer here.

Risk-free rate of return refers to the funds to invest in a no-risk of investments that can get yields. Risk Free Rates RFRs have been developed on a currency-by-currency basisRFRs are fundamentally different from IBORs. The overall objective of the Working Group on Sterling Risk-Free Reference Rates RFRWG is to catalyse a broad-based transition to SONIA by the end of 2021 across the sterling bond loan and derivative markets in order to reduce the financial stability risks arising from the widespread reliance of financial markets on GBP LIBOR.

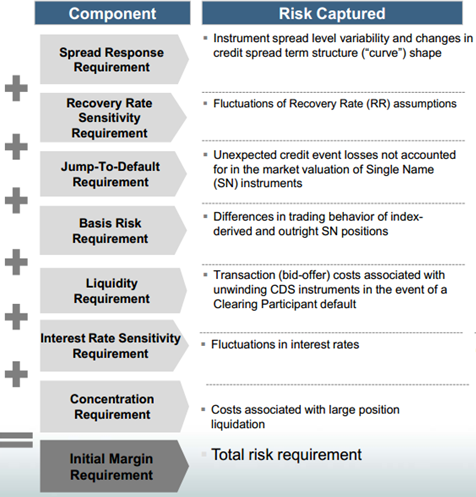

K c is the risk-adjusted discount rate also known as the Cost of Capital. The RFR Portal includes the ICE Risk Free Rates RFR Calculator published and realised average RFR data for SOFR SONIA TONA and STR and the ICE Term SONIA Reference Rates. ICE Risk Model is a margin calculation tool that supports the calculation of original margin amounts for products cleared by ICE Clear Europe based upon the ICE Risk Model specification.

A risk-free rate of return formula calculates the interest rate that investors expect to earn on an investment that carries zero risks especially default risk and reinvestment risk over a period of time. Preliminary Daily and Historical Volume Open Interest Data. Initial Commitment Start Date End Date Add Commitment Change.

The risk-free rate represents the interest an investor would expect from an absolutely risk-free investment over a specified period of time. As the calculation of a compounded rate can be complex. We are seeking feedback from market participants on the information presented here and how it can be improved further to provide support in the transition from LIBOR towards Risk Free Rates.

Any rates calculated should not be used as a benchmark nor as a reference or input in financial instruments. ICEs interest rates derivatives clear through ICE Clear Europe enabling up to 80 margin offsets depending on expiriescurrencies. Commodity and Indices Data.

Risk-free bond issues by a government or agency whose risks of default are so low as to be negligible. Any rates calculated should not be used as a benchmark nor as a reference or input in financial instruments. IBA started publishing indicative GBP SONIA Spread-Adjusted ICE Swap Rate Beta settings from May 5 2021 for an initial testing period.

Risk Free Rates. The risk-free rate represents the interest an investor would expect from an absolutely risk-free investment. Generally this rate of return will be regarded as the basic return and then various risks that may arise are considered.

IBA expects this webpage to be a valuable resource for market participants providing three key pieces of information on alternative risk free rates on a daily basis. Since it carries no risk all other investments which carry some amount of risk must offer a higher return to attract investors. Report detailing trader positions.

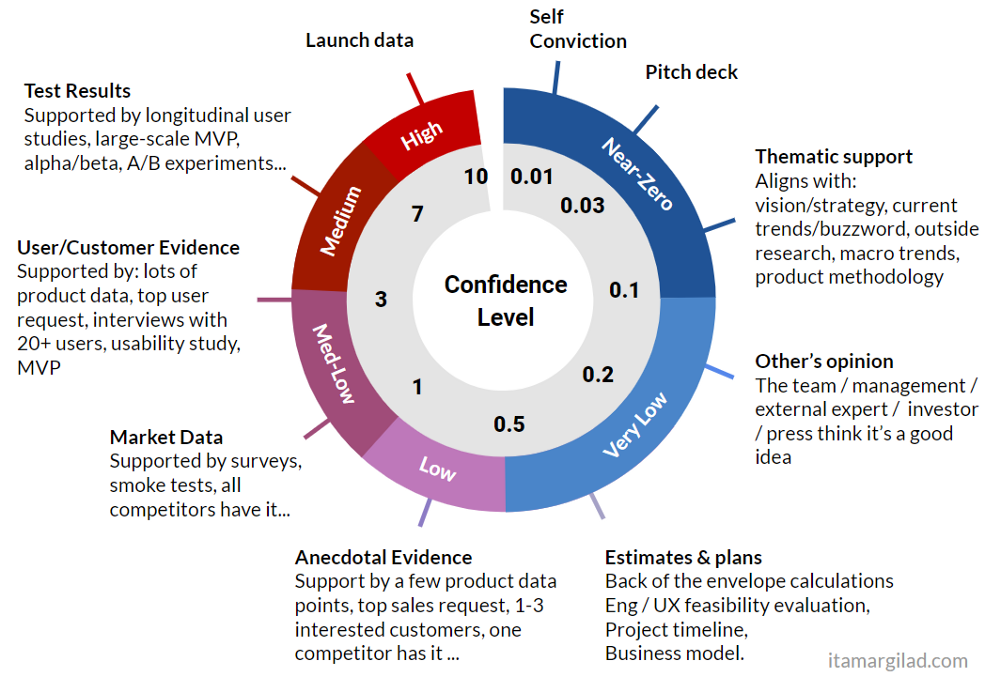

Idea Prioritization With Ice And The Confidence Meter

Vrr Launches Free Online Dry Ice Calculator For Your Rkn And Rap Cool Containers

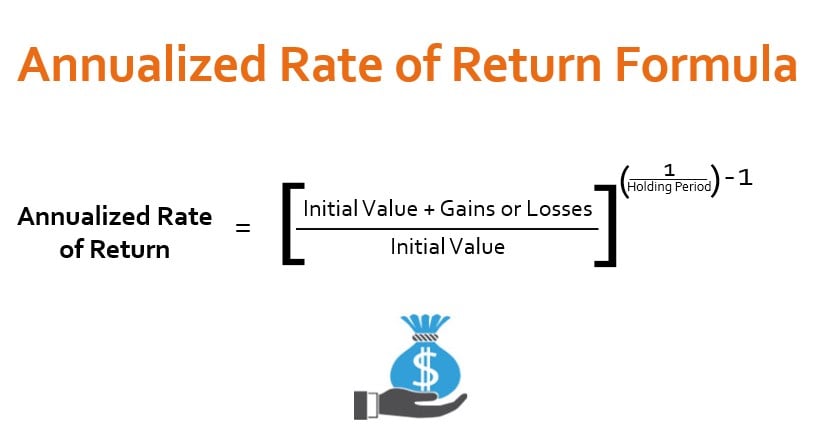

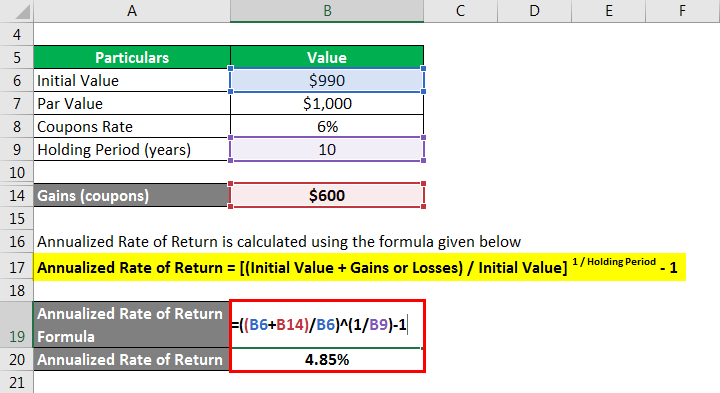

Annualized Rate Of Return Formula Calculator Example Excel Template

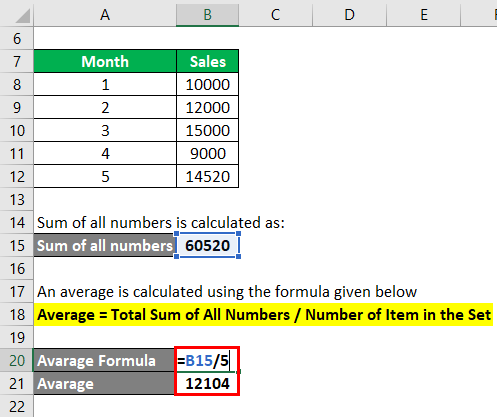

Average Formula How To Calculate Average Calculator Excel Template

Clearing Risk Management For Futures Options Cds Ice Clear Europe

Tutorial How To Calculate The Weights Of Whole Milk Powder And Cream Required For An Ice Cream Mix

2021 Snow Removal Prices Plowing Rates Services Calculator

Clearing Risk Management For Futures Options Cds Ice Clear Europe

Clearing Risk Management For Futures Options Cds Ice Clear Europe

Isda Ibor Fallbacks Methodology And Bloomberg Publication Youtube

Clearing Risk Management For Futures Options Cds Ice Clear Europe

Capital Asset Pricing Model Capm Magnimetrics

Clearing Risk Management For Futures Options Cds Ice Clear Europe

Annualized Rate Of Return Formula Calculator Example Excel Template

Download Excel Freezing Point Depression Curve For Ice Cream Software

Post a Comment for "Ice Risk Free Rate Calculator"